Break Even Analysis Advantages and disadvantages table in A Level and IB Business Studies

Have you been curious about where all the money was going? Almost every startup owner has this problem when running their business. Even after carefully examining your finances thoroughly, this might happen only to realize that you aren’t aware of all your expenses. And nobody likes missing expenses because the anxiety that comes from not knowing where you’re headed can be a little hard to handle. As an entrepreneur, you must have a particular revenue target that guides you on the set goals you need to achieve within a certain timeline.

It is helpful in knowing the effect of increase or reduction in selling price. The number of units produced and sold will be the same so that there is no opening or closing stock. When the break even sales are low, but not very low with moderate angle of incidence, in that case, though the business is stable, the profit earning rate is not very high as in earlier case. It provides an opportunity to review what optimum mix of products or services works for your business. It provides an insight into the characteristics of your true cost base,which costs are fixed and which vary depending on your level of income or production. Advantages and disadvantages of switching from Windows to Linux?

How to Send Money Online Using a Credit Card

This is where break-even analysis plays a vital role in your business by removing any emotion when making crucial business decisions. Many startups often struggle with financing, hence resort to drawing up a business plan issued to interested investors. The break-even analysis is one component you must include in your business plan, enabling you to show your investors that their investment will be profitable. Therefore, break-even is excellent for managing business risk.

1.It is very difficult if not impossible to segregate costs into fixed and variable components. They have a tendency to rise to some extent after production reaches a certain level. Likewise, variable costs do not always vary proportionately. Another false assumption is regarding the sales revenue, which does not always change proportionately.

Break-Even Analysis: How to Predict If Your Next Venture Will Be Profitable

In stock and option trading, break-even analysis is important in determining the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions. It is an essential tool for investors and financial analysts in determining the financial performance of companies and making informed decisions about investments. By understanding the break-even point, investors can make profitable investment decisions and manage risks effectively. Overall, break-even analysis is a critical tool in the financial world for businesses, stock and option traders, investors, financial analysts and even government agencies.

A break-even analysis is a financial method for evaluating when a business, a new service, or a product will become profitable. Running a startup can be stressful, especially when you have no clue if your business will make any money or not. This is why break-even analysis is one of the best ways you can figure out if you’re going to be successful or not.

That’s why they constantly try to change elements in the formulation cut back the number of units need to supply and increase profitability. It is essential that the results from break-even analysis are interpreted correctly and the data is effectively utilized to make better, knowledgeable business choices. For instance, if a break-even analysis of a business reveal that 1000 models must be produced to break-even. These overhead costs occur after the decision to start an economic activity is taken and these costs are directly related to the level of production, but not the quantity of production.

- It’s a helpful tool that clearly outlines both cost-volume-profit and cash flow analysis.

- There is no certainty that costs and prices will be accurate or constant.

- If the contribution is more than the fixed expenses, profit shall arise and if the contribution is less than the fixed expenses, loss shall arise.

- A scale for sales on horizontal axis is selected and other scale for profits and fixed cost or loss on the vertical axis is selected.

Break-even analysis is a very valuable technique for a corporation, and it has a lot of benefits. It demonstrates how many things they must sell in order to make a profit. It determines if a product is worth selling or is too dangerous to sell. It indicates how much money the company will make at each level of output.

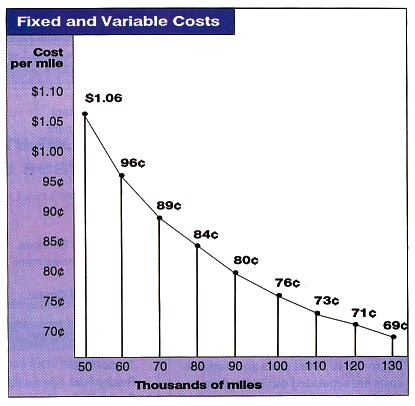

Calculation of sales volume required to meet proposed expenditures. Difficulties with classifying costs.It is not only not easy to separate costs into Fixed Costs and Variable Costs , but some costs simply cannot be conveniently classified into fixed and variable. Also, the introduction of Semi-Variable Costs makes the process of classifying costs much more complicated. Demand changes constantly.Many things may influence demand for products such new fashion trends, health epidemics or simply bad weather forcing people to stay at home instead of going shopping. The Break-even Chart where costs and revenues curves are not linear. A very effective tool in the hands of management is profit planning.

👔 BUSINESS MANAGEMENT:

Break-even analysis is most useful for businesses with only one price point. Break-even analysis may be too simplistic for your purposes if you have many products with numerous pricing. Furthermore, keep in mind that costs can fluctuate, so your break-even threshold may need to be re-evaluated and altered in the future. You’ll need some information before you start your break-even analysis. Assume you’re conducting research for a potential new product.

For example, it assumes that there is a linear relationship between costs and production. Also, break-even analysis ignores external factors such as competition, market demand, and changing consumer preferences, which can have a significant impact on a businesses’ top line. We can also see the number of units to be sold for General Motors to breakeven has increased in 2018, which may be due to the increase in variable cost per unit. It means by selling up to 3000 units, XYZ Ltd will be in no loss and no profit situation and will overcome its fixed cost only.

Breakeven Point and Stock Market

While Indirect Costs appropriation can be conducted, the process is rather subjective. Although there is lots of computer software to help managers to calculate multi-product break-even quantities, these may not truly represent the Break-even Quantity for each product. Profit in the short-term vs long-term.In order to maximize sales in the short-term, managers may decide to reduce prices.

The first financial tool you should use is a break-even analysis. A break-even analysis will calculate what your revenues must be for your business to produce a profit. Profitability of various products can be studied with the help of these charts and a most profitable product mix can be adopted. Profits at different levels of activity can also be ascertained. The chart is very useful for forecasting costs and profits at various volumes of sales. Selling price will remain constant even though there may be competition or change in volume of production.

And, not all of the production workers are paid the same wages per piece or per hour – labor costs may increase as output reaches maximum due to higher overtime rates. Break-even analysis is the process of calculating and evaluating an entity’s margin of safety based on collected revenues and corresponding costs. To put it another way, the research demonstrates how many sales are required to cover the cost of doing business. In accounting and business, the breakeven point is the production level at which total revenues equal total expenses. Break-even analysis is of vital importance in determining the practical application of cost functions. It is a function of three factors, i.e., sales volume, cost and profit.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

The Importance of Break-Even Analysis to Businesses

And by using it, you’ll be able to predict the outcome of any business decision and make informed decisions accordingly. But with a break-even analysis, taking control is possible. The break-even analysis helps your business advantages and disadvantages of break even analysis identify the point where revenues equal costs, and when this occurs, the business has achieved its goal of breaking even. Measures the profit and the losses and for production and sales at many different levels.

Break-even Analysis is also quite flexible as it can be drawn and redrawn in the Excel spreadsheet in order to visualize ever-changing business environment. Updating all the costs and revenues data is also fairly simple. Break-even point is considered a measurement tool that is used in cost accounting, business, and economics to determine the point when both the total cost and revenues are even. The breakeven point is defined as the point where both total expenses and total revenues are equal to each other.