cash disbursement form: Fill out & sign online

Content

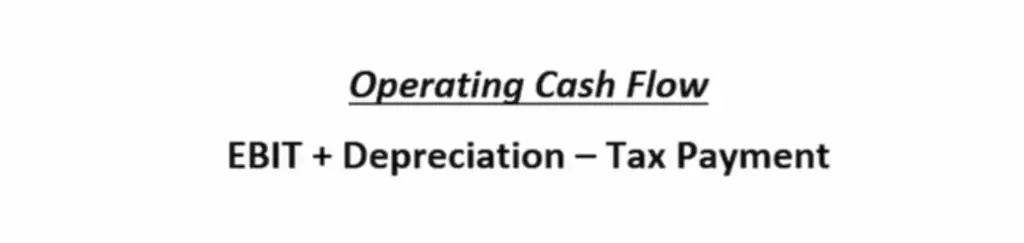

When you automate cash disbursements, you free up valuable time for your accounting team. An automated accounting system like Accounting Seed makes it easy to put your cash disbursements on autopilot. Companies record noncash expenses in their income statement, but there’s no cash transaction attached. When a business enters depreciation into the income statement, that entry lowers the net profit without a cash disbursement. A positive disbursement happens when you create a credit in an account.

You record income when you book the sale, not when you receive the payment. Keeping track of cash disbursements helps you better manage your cash flow. Your cash disbursement journal is a record of all of your business’s outflowing cash. By itemizing all cash payments, this journal helps businesses organize their outgoing cash records. For instance, a retailer would have many payments for inventory, accounts payable, and salaries expenses. A manufacturer might have entries for raw materials and production costs.

Recording cash payments in a cash disbursements journal

Under the periodic inventory method, the July 6 shipping costs would go to a Transportation In account and the July 25 discount would go to Purchases Discounts. Some businesses keep a https://www.bookstime.com/ to record these types of transactions before posting them to the company’s general ledger, according to BooksTime. Companies use cash disbursement journals to record information about the transactions, such as date, amount, payee, invoice number, check number and notes.

Poor cash flow leads to missed business opportunities, lost revenue, damaged relationships with employees and vendors, and can even lead to closing shop. After creating a cash disbursement journal, your work isn’t over. Use the information from your cash disbursement journal to update your other records. When it comes to recording cash disbursements, be as specific as possible. Don’t just include the amount of money you spent on the transaction.

Cash Disbursement Journal Report

To be able to run the Cash Disbursement Journal for business places, you need to assign business places as organizational units to the reporting entity. Type text, add images, blackout confidential details, add comments, highlights and more.

What are the 6 types of journals?

- academic/scholarly journals.

- trade journals.

- current affairs/opinion magazines.

- popular magazines.

- newspapers.